Secure your dream retirement with Anna Eiken's "Retirement Planning That Works." This comprehensive guide simplifies the often-daunting process of planning for your golden years. From maximizing savings with 401(k)s and IRAs to navigating healthcare costs with Medicare and HSAs, this all-in-one resource provides clear, actionable steps. Packed with checklists, worksheets, and planners, the book covers essential topics such as Social Security optimization, withdrawal strategies, and estate planning. No more guesswork; "Retirement Planning That Works" empowers you to create a personalized plan, ensuring a financially secure and fulfilling retirement tailored to your individual needs and goals. Start planning your worry-free future today.

Review RETIREMENT PLANNING that WORKS

This book, "Retirement Planning That Works," completely exceeded my expectations. Initially, the sheer volume of information related to retirement planning felt daunting, a vast and confusing landscape. This book, however, acts as a wonderfully clear and concise map guiding you through that landscape. It doesn't shy away from the complexities of 401(k)s, IRAs, HSAs, Medicare, and Social Security, but it breaks down each element with remarkable clarity. The author, Anna Eiken, possesses a talent for simplifying complex financial topics, making them accessible to even those with limited financial expertise.

What truly sets this book apart are the practical tools included. The checklists, worksheets, and planners are not mere afterthoughts; they're integral to the learning process. The Retirement Expense Worksheet, for instance, was an absolute game-changer. It forced me to confront my spending habits and project future expenses in a way that spreadsheets or mental estimations simply couldn't achieve. Similarly, the Healthcare and Insurance Coverage Tracker offered a much-needed organizational framework for a topic I previously found overwhelming. These tools are more than just helpful aids; they're essential components in creating a realistic and personalized retirement plan.

I particularly appreciated the book's holistic approach. It doesn't simply focus on the financial aspects of retirement but also addresses the crucial lifestyle elements. The advice on maintaining social engagement and preparing for the inevitable changes that come with aging felt incredibly thoughtful and relevant. Many retirement guides focus solely on numbers, overlooking the emotional and social well-being that's equally vital for a fulfilling retirement. This book deftly balances both aspects.

The writing style is friendly and approachable, avoiding jargon and technical terminology that often confuse readers. The tone is reassuring and encouraging, making the often-intimidating subject of retirement planning feel manageable. Instead of creating anxiety, the book empowers you to take control of your future, step by step. It fosters a sense of confidence that you can indeed build the retirement you envision, even if you’re starting from scratch.

In short, "Retirement Planning That Works" is more than just a guide; it's a comprehensive toolkit designed to equip you with the knowledge, resources, and confidence to plan a secure and fulfilling retirement. Whether you're just beginning to think about retirement or are looking to refine your existing strategy, this book is an invaluable resource. I highly recommend it to anyone seeking a practical, actionable, and ultimately reassuring guide to navigating the complexities of retirement planning. It's a true treasure trove of information presented in a way that’s both accessible and enjoyable.

Information

- Dimensions: 6 x 0.42 x 9 inches

- Language: English

- Print length: 184

- Publication date: 2024

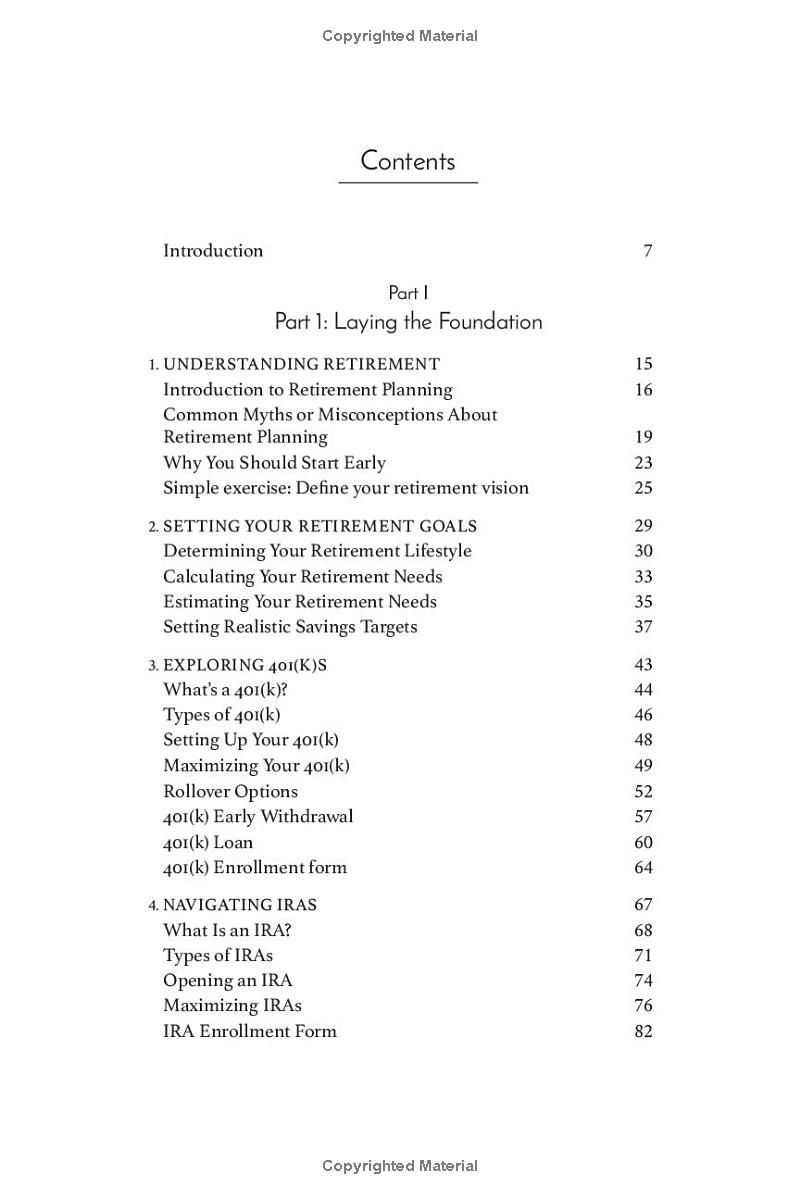

Book table of contents

- Introduction

- Part 1: Laying the Foundation

- Understanding Retirement

- Setting Your Retirement Goals

- Exploring 401(k)s

- Navigating IRAs

- Part II

- Part 2: Building and Protecting Your Wealth

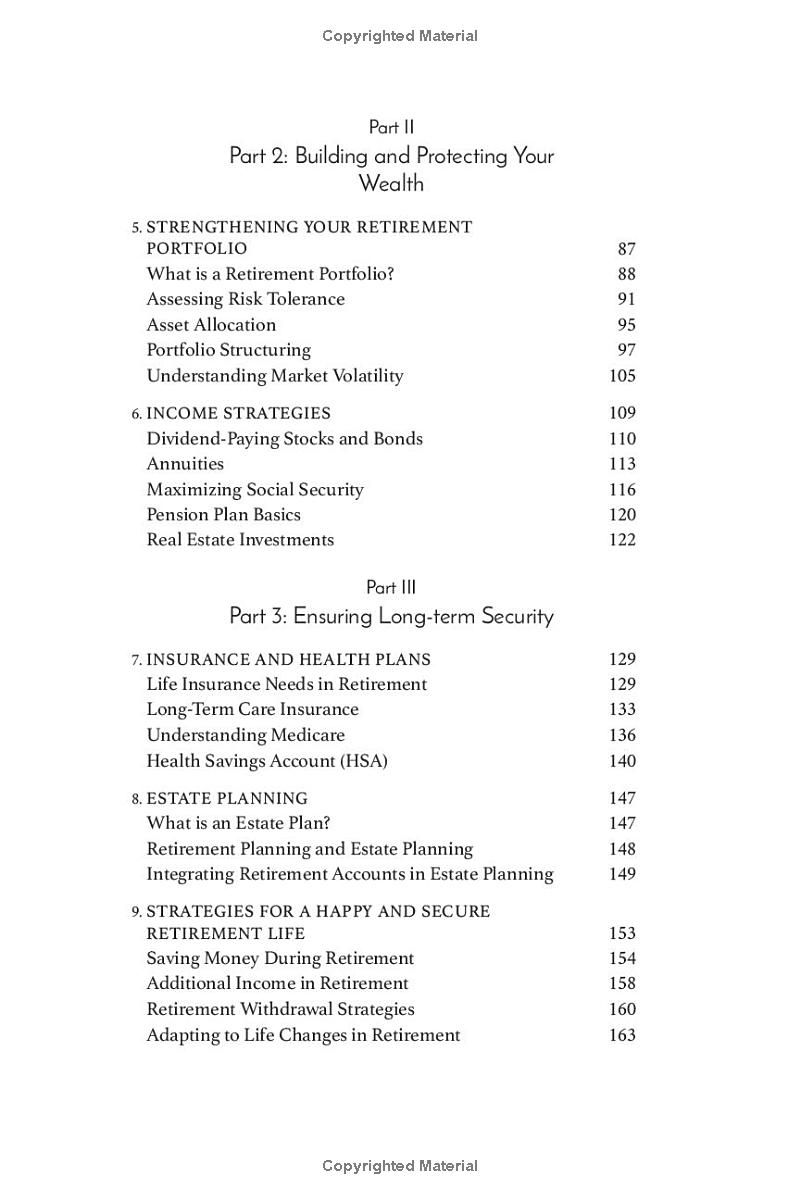

- 5, STRENGTHENING YOUR RETIREMENT PORTFOLIO

- Part III

- Part 3: Ensuring Long-term Security

- INSURANCE AND HEALTH PLANS

- 8.ESTATE PLANNING

- 9. STRATEGIES FOR A HAPPY AND SECURE RETIREMENT LIFE

- Introduction

Preview Book